1040-ES Form Download

Before diving into how to get Form 1040-ES, it's important to understand what this document is for. The 1040-ES form estimates your taxes for the year and is especially relevant for individuals who do not have their taxes automatically withheld, such as self-employed individuals or investors. It helps you calculate and pay your estimated quarterly taxes, ensuring compliance and potentially avoiding any underpayment penalties later on.

Downloading Form 1040-ES in PDF

To begin with, the process of getting your 1040-ES form, visit our website and follow these simple steps:

- Navigating to the Form

Upon arriving at our homepage, locate the menu to help guide you to the appropriate section, or simply stay on the homepage where the form is featured. - Getting the Form

Look for the "Get Form" button, which is typically easy to find and designed to stand out. Clicking this button will open the PDF file of the IRS tax form 1040-ES for 2023. - Downloading the Form

In the newly opened window, you'll be able to see the arrow button or download icon. Clicking this will initiate the download process. - Choosing the Format

Ensure you select the PDF format when the option appears, as this is the standard and accepted format for government forms. - Saving the File

A window may pop up asking where you'd like to save the form on your device. Choose a location that is easy for you to remember and access later on. - Completion of Download

Submit the required actions and wait a few seconds for the download to complete successfully. After this, you should have the form saved on your device.

Filling Out the 1040-ES Template

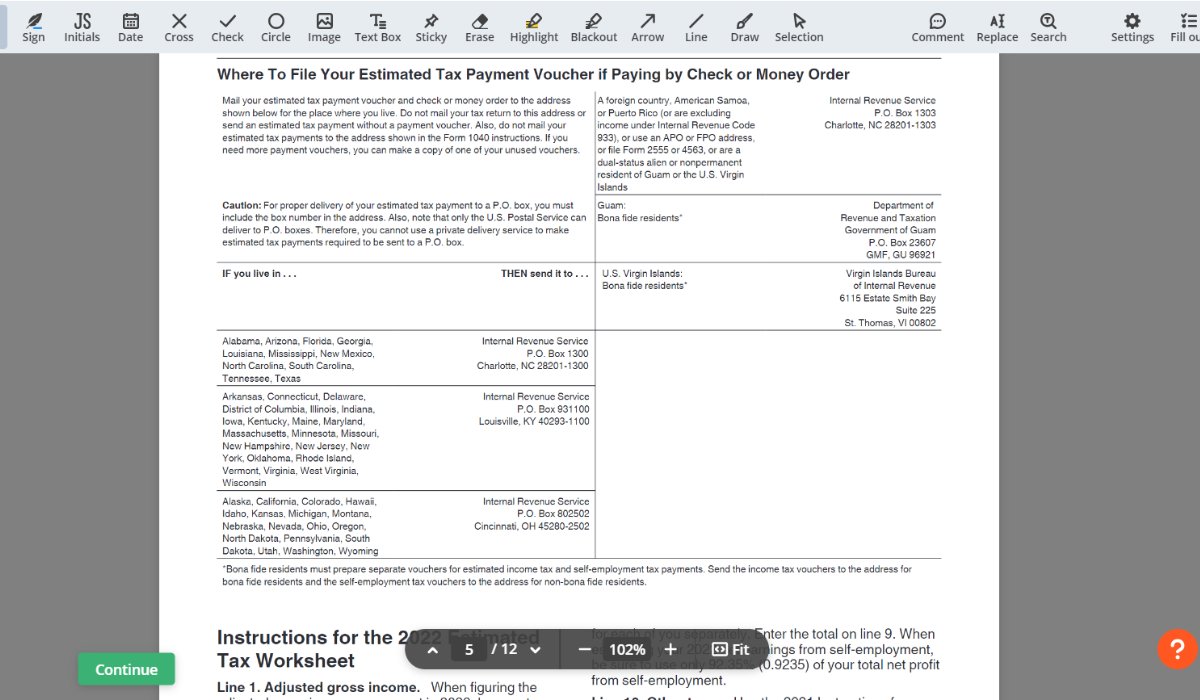

Once you have IRS Form 1040-ES for 2023 downloaded, you'll need to fill it out carefully, following the IRS guidelines:

- Enter your personal information, including your name, address, and social security number.

- Determine your estimated income for the upcoming year. This includes all sources of income, such as wages, dividends, interest, and business earnings.

- Use the worksheet provided in the form to calculate your estimated tax liability for the year.

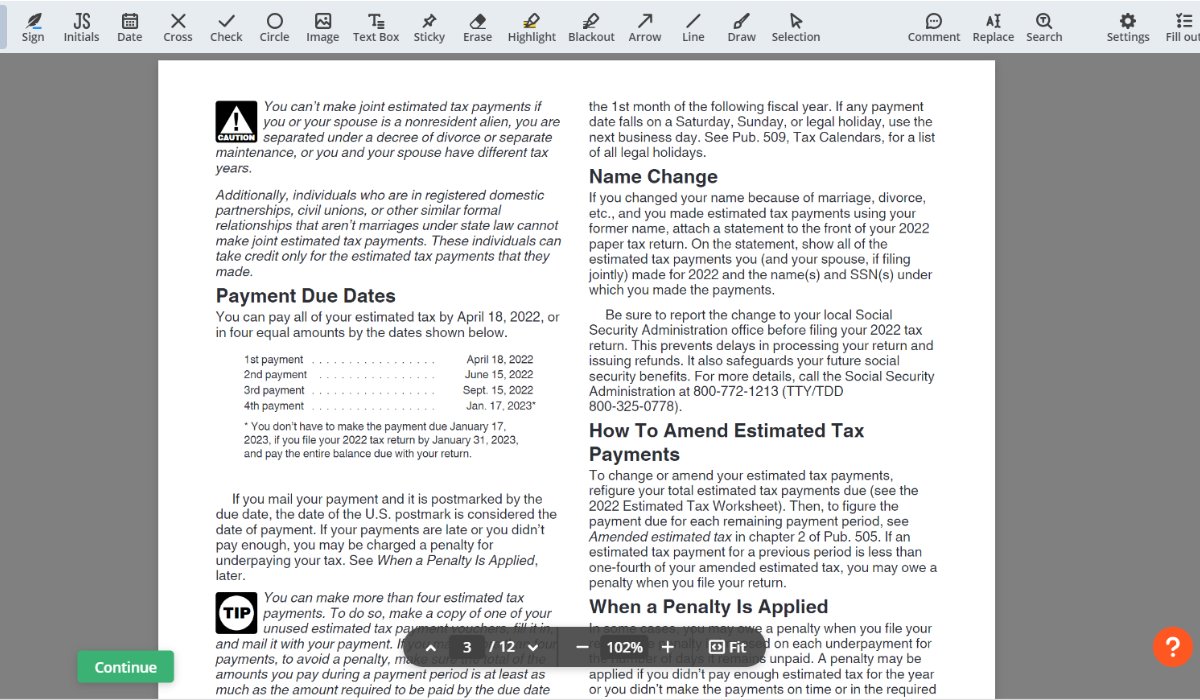

- Split the estimated fiscal liability into four equal payments, which represent your quarterly estimated tax payments.

- Make payments by the due dates established by the IRS, which are usually April 15, June 15, September 15 of the current year, and January 15 of the following year.

- Keep a copy of the completed 1040-ES printable form for 2023 and any confirmation or transaction numbers associated with your payments for your records.

If you need additional assistance or have specific questions about the form or your estimated taxes, it's always best to consult a tax professional. Remember, paying your taxes correctly and on time is crucial to avoid any penalties and ensure financial compliance.

Now that you have the steps go ahead and download Form 1040-ES conveniently on our website. Stay ahead with your tax obligations and ease your tax season stress.