1040-ES Estimated Tax Form

For individuals who earn income not subject to withholding tax, the IRS requires the payment of estimated taxes throughout the year. This is where IRS Form 1040-ES for estimated tax comes into play. The form serves as a guide for taxpayers to calculate and pay their estimated taxes every quarter. Self-employed individuals, investors, and others with significant non-wage incomes need to handle their tax obligations proactively to avoid underpayment penalties.

Recent Changes to the 1040-ES Estimated Tax Form

In recent years, there have been updates to IRS Form 1040-ES for estimated tax and filing guidelines to streamline the payment process and adjust for tax legislation changes. These changes may include adjustments to the income brackets, alterations in the standard deduction amounts, and updates to the worksheet used to calculate the estimated tax. It's critical to check the latest version of the form every year to ensure compliance with the current tax laws and regulations.

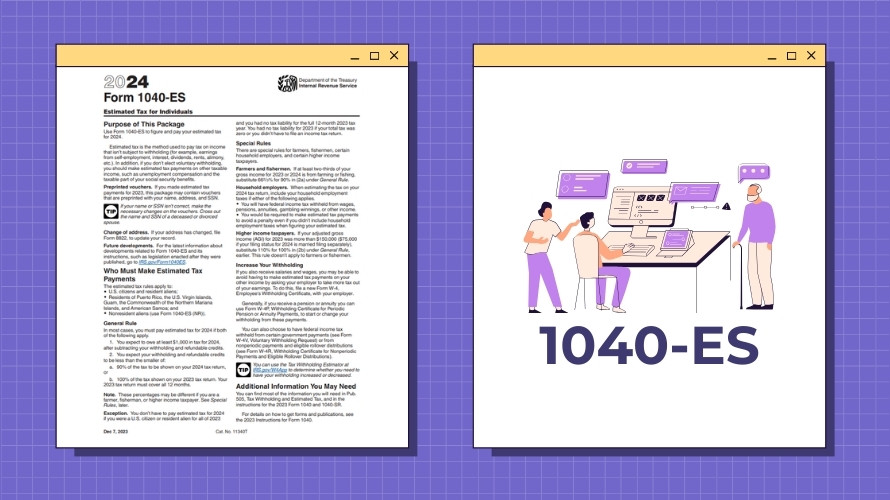

Who Should Use the 1040-ES Estimated Tax Form?

The 1040-ES form is primarily used by taxpayers who do not have taxes automatically withheld from their income or whose withholding is insufficient. This includes self-employed individuals, independent contractors, and those with income from dividends, interest, alimony, rent, or gains from the sale of assets. However, if your prior year's adjusted gross income was more than $150,000 ($75,000 if married filing separately), you might want to follow special rules for higher-income earners.

Individuals are exempt from paying estimated taxes in certain cases. For instance, if you had no tax liability in the previous year, you were a U.S. citizen or resident for the whole year, and your previous fiscal year covered 12 months, you might not be required to file the 1040-ES estimated tax form for 2023.

Tips for Filling Out the 1040-ES Tax Form

- Maintain Financial Records

Keep detailed records of your income and deductions throughout the year. This will simplify the process of calculating your tax due each quarter. - Utilize Tax Software or a Professional

Reliable tax software can help estimate your taxes and fill out the form correctly. Alternatively, a tax professional can provide valuable assistance. - Estimate Income Conservatively

It's better to overestimate your income slightly than to underestimate it and risk underpayment penalties. - Review Tax Law Changes

Stay informed about any changes in tax law that could affect your estimated payments in 2023. - Electronically Filing

Consider using the Electronic Federal Tax Payment System (EFTPS) to submit your payments. It's secure, convenient, and ensures you have a clear record of your transactions.

Paying estimated taxes accurately and on time is crucial for staying compliant with the IRS and avoiding unnecessary penalties. Consult with an advisor if you have any uncertainties about properly using the 2023 1040-ES estimated tax form.

Latest News